The Critical Importance of Dynamic Token Modeling

Here's the deal when launching a token. Most do it without proper modeling which is akin to performing surgery with a butter knife.

While 90% of token projects fail due to inadequate planning, many teams still rely on static spreadsheets, clinging to a false sense of control. It's 2025. This approach is outdated.

Daniel Tauhore, CEO of Tokenise, emphasizes, "The complexity of today's token economies demands a more sophisticated approach. Static models simply can't capture the intricate dynamics at play."

Let's explore why dynamic modeling is crucial and how it can revolutionize your token launch strategy.

The Pitfalls of Static Spreadsheets

Spreadsheets have long been the go-to tool for financial modeling, but they fall woefully short when it comes to token economics.

Here's why:

Limited Scope

Static models often rely on linear projections, failing to account for the complex, interconnected nature of crypto markets. They assume a level of predictability that simply doesn't exist in real-world scenarios.

False Confidence

Complex spreadsheets can create an illusion of accuracy. However, they often rely on unrealistic assumptions that don't hold up under market pressures.

Inability to Adapt

In the rapidly changing crypto landscape, static models become obsolete almost as soon as they're created. They can't adjust to new information or market shifts in real-time.

Static modeling often fails to capture the complex interactions of token economics, while dynamic modeling accounts for feedback loops and real-time market conditions.

Understanding Token Launch Models and Their Modeling Requirements

The pitfalls of static modeling become even more pronounced when considering the diverse landscape of token launch methods. Each launch model creates unique market dynamics that require specialized modeling approaches.

Common Token Launch Models

Initial DEX Offerings (IDOs): Require models that account for immediate liquidity dynamics and potential price volatility

Initial Coin Offerings (ICOs): Need longer-term models focusing on gradual token distribution and utility adoption

Liquidity Bootstrapping Pools (LBPs): Demand sophisticated price discovery modeling with changing weight parameters

Initial Exchange Offerings (IEOs): Must account for centralized exchange dynamics and potential listing effects

Different launch methods create distinct market behaviors that static spreadsheets simply cannot predict. For example, an LBP launch requires modeling that accounts for the progressive adjustment of token weights, while an IDO requires detailed analysis of initial liquidity ratios and potential market depth.

As Daniel Tauhore notes, "Your launch method fundamentally changes the parameters you need to model. An IDO has completely different liquidity considerations than a gradual distribution through a bonding curve."

The Dynamic Difference: Understanding Market Complexities

Dynamic modeling tools, like those offered by Tokenise, provide a more realistic and adaptable approach to token economics.

Here's what sets them apart:

Feedback Loops and Network Effects

Dynamic models account for the complex interplay between various market factors. They can simulate how changes in one area (e.g., token price) affect others (e.g., holder behavior, liquidity).

Scenario Testing

With dynamic modeling, you can test multiple "what-if" scenarios, providing a more comprehensive view of potential outcomes. This allows for better risk assessment and strategy refinement.

Real-time Adjustments

As market conditions change, dynamic models can be updated in real-time, ensuring your strategy remains relevant and effective.

Visualizing Token Economics: Beyond Charts and Graphs

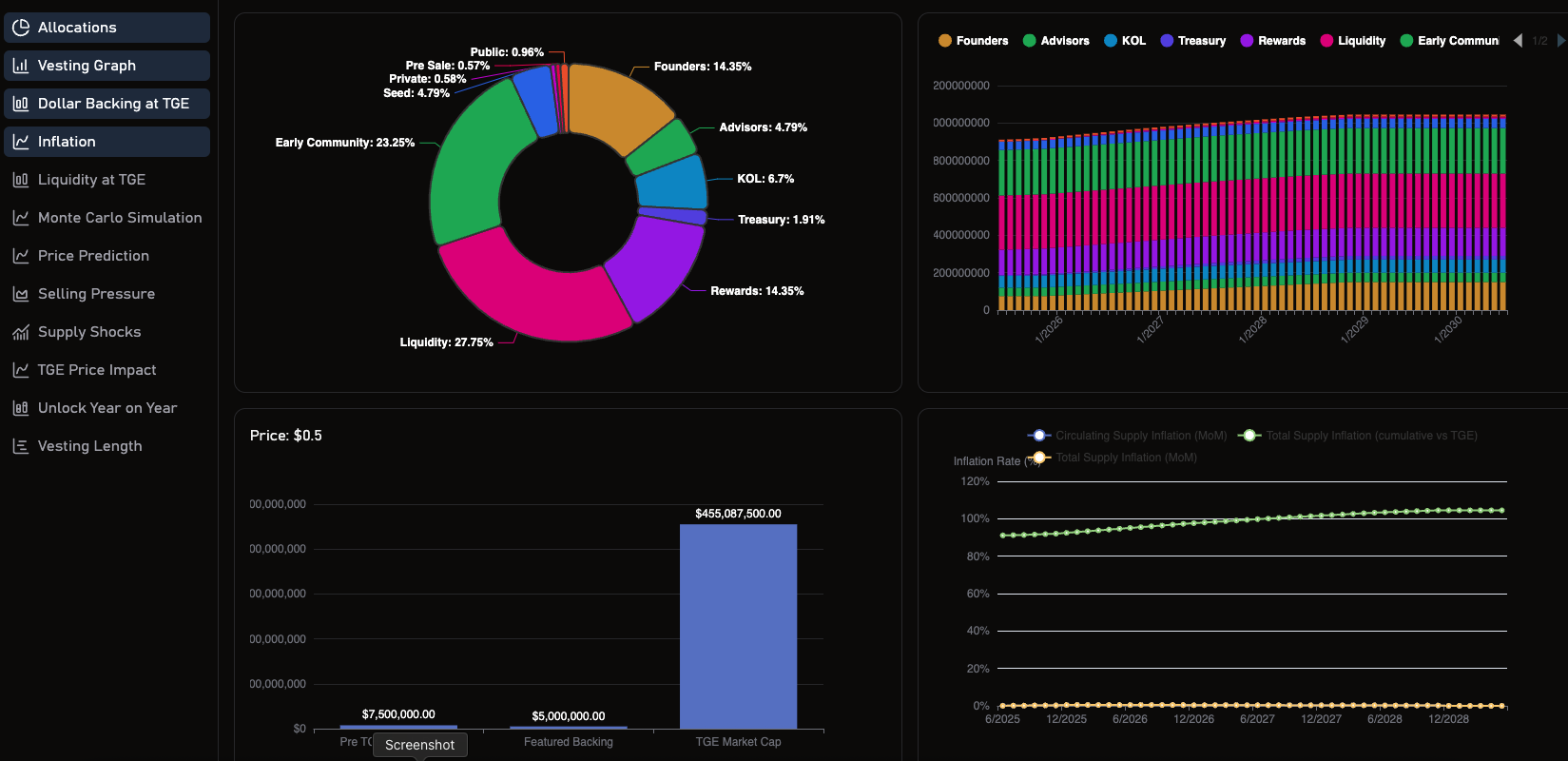

One of the most powerful aspects of dynamic modeling is its ability to visualize complex economic relationships. Tokenise's platform offers advanced visualization tools that go far beyond traditional charts and graphs.

Sell Pressure Visualization

See how different vesting schedules and token allocations could impact selling pressure over time.

Stability Score Concepts

Visualize the overall stability of your token economy based on multiple factors, helping identify potential weak points.

Supply Shock Modeling

Understand how sudden changes in token supply could affect your token's ecosystem.

Tokenise's modeling interface allows users to visualize complex token dynamics including supply shock impacts and vesting-related selling pressure.

Critical Metrics in Token Modeling

When modeling your token, certain metrics deserve special attention:

Initial Unlock and Liquidity

The amount of tokens available at launch and the initial liquidity provided are crucial factors in a token's early performance. For IDOs, the typical best practice is to allocate between 2-5% of the total token supply for initial liquidity, while maintaining a reasonable initial market cap.

Supply and Liquidity Balance

Maintaining the right balance between token supply and available liquidity is essential for price stability and trading volume. Dynamic modeling helps identify the optimal ratio for your specific token economy and launch method.

Tokenise's platform includes an initial liquidity at TGE (Token Generation Event) checker, helping projects avoid the dreaded "dead on arrival" scenario where insufficient liquidity leads to immediate price crashes.

Predictive Modeling: Anticipating and Solving Problems

One of the most valuable aspects of dynamic modeling is its predictive power. By running multiple scenarios and stress tests, you can identify potential issues before they become real-world problems.

Iterative Improvement

Use the insights from predictive modeling to refine your tokenomics, vesting schedules, and launch strategy. This iterative process can significantly improve your chances of success.

Common Issues Identified

Through predictive modeling, teams often uncover problems with:

Vesting schedules leading to sell pressure spikes

Insufficient liquidity during critical periods

Misalignment of incentives among different stakeholder groups

A Comprehensive Launch Checklist: Beyond Modeling

While dynamic modeling is essential, it's part of a broader launch framework. A comprehensive token launch checklist integrates modeling with operational readiness:

Pre-Launch Preparation

Whitepaper Quality: Ensure thorough documentation of tokenomics, utility, and distribution mechanisms

Team Assembly: Form a balanced team with expertise in development, economics, and marketing

Regulatory Compliance: Conduct legal reviews to ensure compliance with relevant regulations

Security Audits: Complete comprehensive smart contract audits from reputable providers

Technical Considerations

MEV Protection: Implement mechanisms to prevent miner/maximal extractable value exploitation

Liquidity Strategy: Determine optimal initial liquidity, AMM parameters, and long-term liquidity incentives

Vesting Contract Security: Ensure vesting contracts have been properly audited and tested

Contract Upgradeability: Consider whether contracts need upgrade paths for future improvements

Market Readiness

Community Building: Establish an engaged community before launch

Liquidity Venue Selection: Choose appropriate DEXs or CEXs based on target audience and token design

Price Discovery Mechanism: Select appropriate mechanisms based on token distribution goals

Post-Launch Monitoring Plan: Establish processes for tracking key metrics after launch

Integrating this checklist with dynamic modeling ensures both technical and market readiness. As your model identifies potential issues, your operational checklist should evolve to address them.

Emerging Strategies for Successful Token Launches in 2025

As the token launch environment continues to evolve, several key strategies are emerging as best practices for 2025:

Clarity of Token Purpose

Successful projects clearly articulate why tokenization serves their platform better than traditional alternatives. Dynamic models should explicitly test and demonstrate the token's utility and value accrual mechanisms.

Strategic Partnerships

Leading projects establish strategic partnerships before launch to ensure immediate utility and distribution. Your dynamic model should account for partner integrations and their impact on token adoption curves.

Community-Centric Approach

The most resilient token economies prioritize community ownership and governance from day one. Models must account for progressive decentralization and community incentive alignment.

Transparent Marketing

Successful launches prioritize education over hype, with clear communication about tokenomics and risk factors. Your launch strategy should include educational content based on insights from your dynamic modeling.

Regulatory Adaptation

Forward-thinking projects design tokenomics that can adapt to evolving regulatory frameworks. Dynamic modeling should include regulatory scenario testing to ensure long-term viability.

The Path to Sustainable Token Economics

As we've explored, dynamic modeling is not just a nice-to-have—it's a necessity for any serious token project. By leveraging advanced tools like those offered by Tokenise, you can:

- Gain a more accurate understanding of your token's potential performance

- Identify and mitigate risks before they become critical issues

- Adapt your strategy in real-time as market conditions change

- Increase your chances of a successful, sustainable token launch

Remember, in the world of token economics, forewarned is forearmed. Don't let your project become another statistic in the 90% failure rate. Embrace dynamic modeling and set your token up for long-term success.

Ready to build sustainable tokenomics? Visit launch your token on Tokenise to access professional-grade token engineering tools.

Disclaimer: This analysis is based on public information and should not be considered financial advice. Always conduct your own research before making any investment decisions.

Sources

Impossible Finance: TGE Complexities

Blockapex: Types of Token Launches

Kairon Labs: Token Launch Checklist

OnChain: How to Launch a Token and Grow a Sustainable Project

Lunar Strategy: Top 5 Tips for Successful Token Launch in 2025